Texmo Precision Castings has a very unique perspective on manufacturing trends. With locations in the US, UK, and India we are directly involved with the three largest and most interconnected markets in the world. As such, we at TPC are obviously very interested in how manufacturing opportunities are spread about the world and what the current trends are. One of the biggest trends, which just this year has seriously been discussed in the media, is the reshoring trend in North America. This along with a trend in foreign direct investments in India has been very beneficial to both our business and our customers’ success. Below we provide some metrics and case studies highlighting these trends.

Why are we now seeing these trends? After so many years of moving manufacturing outside of North America, why are they just now starting to come back? Obviously many factors influence the trends of major economic markets – making these types of questions quite difficult to answer; but if we take a look at a few major influences, we begin to see a picture form of how the current economic climate is shaping the global manufacturing industry. Let’s analyse the claim that reshoring is in fact taking place in North America.

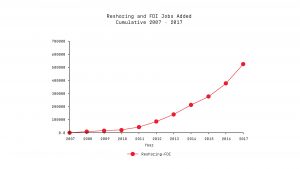

Figure 1: Trend of Total Jobs Added to the US Economy from Foreign Nation

The chart above, Figure 1, shows a dramatic increase in jobs added to the US from a combination of both Reshoring and Foreign Direct Investments. What Figure 1 shows is exponential growth in the creation of jobs within the US since 2007. While some of the growth post 2008 could be associated to economic recovery and as such a higher amount of jobs created by foreign direct investments (FDI), a breakdown of job creation by FDI and reshoring shows the complete story.

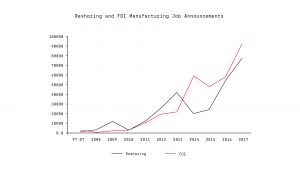

Figure 2: Job Creation by FDI and Reshoring

The chart in Figure 2 differs slightly from Figure 1 as the Y-axis is defined by job announcements rather than jobs added and as such is more of a predictive figure. The important take away from this chart is that though FDI did continue on an increasing trend after the economic recovery, reshoring did not see the same explosion of growth until about 2016. While reshoring has been growing steadily since 2008 with a notable spike in 2013, it did lag behind the FDI boom of 2014 and 2015. Both FDI and reshoring have continued to grow rapidly through 2016 and 2017. While geopolitical influences have definitely left a mark on this uptick in job creation from both FDI and jobs returning to the US and North America, other factors are at play.

As TPC deals with substantial players in the economies of North America, Europe, and Asia, we have seen first-hand some of the driving factors for this trend. One of the major factors is that globalization has been so successful that forced firms to move manufacturing back to the locations where their goods will be sold. The benefits of low cost labour in Asia are rapidly fading away. As globalization continues to level the economic playing field, labour cost continues to increase in areas which where once very enticing locations for manufacturing sites. At the same time that labour was rising, the world was changing.

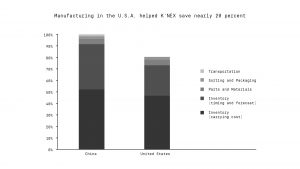

The world is not the same as it was in the 90’s. It is not even the same as it was a decade ago. The world continues to change at an ever increasing pace, much due in part to the massive adoption and integration of the internet into our daily lives. Consumer patience is thinning. It is now expected that goods be delivered not only rapidly but conveniently and at a competitive pricing. Consumers have never been more informed. Never in human history could a prospective buyer search sellers all across the world, comparing quality and price, and once a decision is made expect their goods to show up on their doorstep within a matter of days. Retailers and OEM’s need to be able to react to customer demands and fast. An example of this is an OEM reaching customers via retailers. If a major retailer decides to put a certain product on sale, demand for the product could change drastically. If an OEM is waiting for 90 days for components to ship across the sea from China, they may not be able to produce enough assemblies and miss out on potential sales. Alternatively, they could pay for air shipments and while satisfying customers, destroy their profit margins. This is just one of the many indirect costs of dealing with manufacturing locations far away from the point of sale. One publicly available case study for this comes from the toy maker, K’NEX, who saved 20% of their manufacturing cost by moving from China to the United States.

Figure 3: Reshoring Savings Case Study

Figure 2, shown above, gives a nice breakdown of the different costs of manufacturing. One of the biggest factors identified in this case study is inventory. Not having the flexibility to react to market changes or needing to store additional inventory adds considerable cost to buying manufactured components. As our business metrics become ever more detailed and more and more firms adopt live data dashboards for making decisions, factors such as increased labour cost, lack of flexibility, lost sales, and shipping costs have become ever more apparent.

Because of this, many firms are finding that the indirect costs of distant manufacturing are eating up any additional profits that they may have saved in labour. Additional factors such as communication issues and proximity from buyer to manufacturing location, or engineer to engineer, can also cause costly delays in problem resolution. Quality concerns can also be a problem. With manufacturing locations so far away, components are made in large batches and shipped by water which leads to long periods of time between batches. Because of this, any quality issue that does pop up can affect many more parts and the buyer and manufacturer will not learn of the problem until much later

All of these factors have stacked up to push firms to move their manufacturing closer to the point of sale, even if it means paying more for labour. The indirect costs have simply overtaken the savings. Sprinkle a few geopolitical threats and tariffs on top and you end up with the current global economic climate.

While the information above may yield good results for TPC US manufacturing location, it would seem as if our India location would be proportionally suffered by these economic changes; well, that’s not quite the case. TPC has done an excellent job of putting itself in position for the economic future. While many others were saving money in North America post-recession, TPC was buying and investing in the US location and getting ready for the inevitable economic boom. But before any of that started, TPC had begun to put actions in place for the India location to thrive in the soon to be changing Asian market.

Early on, TPC highly invested in automation and materials research to ensure that highly efficient and high performance processes were put in place. This was not the norm for Indian manufacturing at the time. The general idea was to keep cost down and excel at the low complexity but high volume parts for North America. Instead, TPC India focused on process development and began to compete directly with European foundries. What this has done is put TPC India in an excellent position to deal with world class firms who are now investing in operations in Asia to serve the growing Asian market.

As the overall standard of living increases in Asia, the demand for high quality products has increased. As such, well established global firms are moving in to fill this void in the market. As these investments happen, they need to be supplied with high quality components from a local manufacturer. This is where TPC has put itself in a great position to serve this growing market. Let’s take a look at some data from this trend.

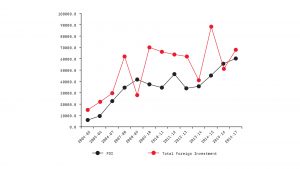

Figure 4: FDI versus FPI in India

Figure 4 shows similar information to what we have seen in Figure 2 for the US. In recent years, FDI has grown rather exponentially in India. There was a lull just after 2008 due to the global recession but has since picked back up around 2014. As the market for high value products continues to grow in Asia, more and more FDI will be required to service this market. These businesses set up by FDI will want to source manufactured components locally for the same reasons so many manufacturing jobs are coming back to the US and North America. At the start of this trend, TPC India positioned itself to be able to grow and compliment this trend – leaving us in a very good position today.

Due to our long term strategies put in place long ago, Texmo Precision Castings now sits in an excellent position in the US, European, and Indian markets. Due to the many different factors detailed above, manufacturing is flowing back to the US. Simultaneously, FDI for the ever maturing Indian market continues to position TPC as a powerful player for the rapidly expanding high quality needs of the domestic Indian market. We continue to keep our eyes on the horizon, looking for any potential changes to these markets which can be further leveraged as we have the economic growth in the US and India.